Nebraska Highlights

- Nebraska assesses income tax based upon the amount of federal taxable income

- No state property tax

- No inventory tax

- No personal property tax on intangibles

- No sales tax on:

○ Raw materials when used as ingredients or component parts in manufacturing operations

○ Sales of energy for processing or manufacturing purposes

○ Water used exclusively in manufacturing and processing

○ Qualified agricultural machinery and equipment

○ Manufacturing machinery, equipment, and related services - Sales and use tax refunds are available on qualifying air and water pollution control equipment

- Sales and use tax refunds are available on property qualifying for certain investment incentives

The Nebraska State Government is financed by an individual income tax, corporate income tax, 5.5 percent sales and use tax, corporate occupation tax, and selective excise taxes (liquor, tobacco, motor fuels, etc.). Local governments are financed primarily by property taxes, although some cities and counties collect a local option sales tax of between 0.5 and 2.0 percent.

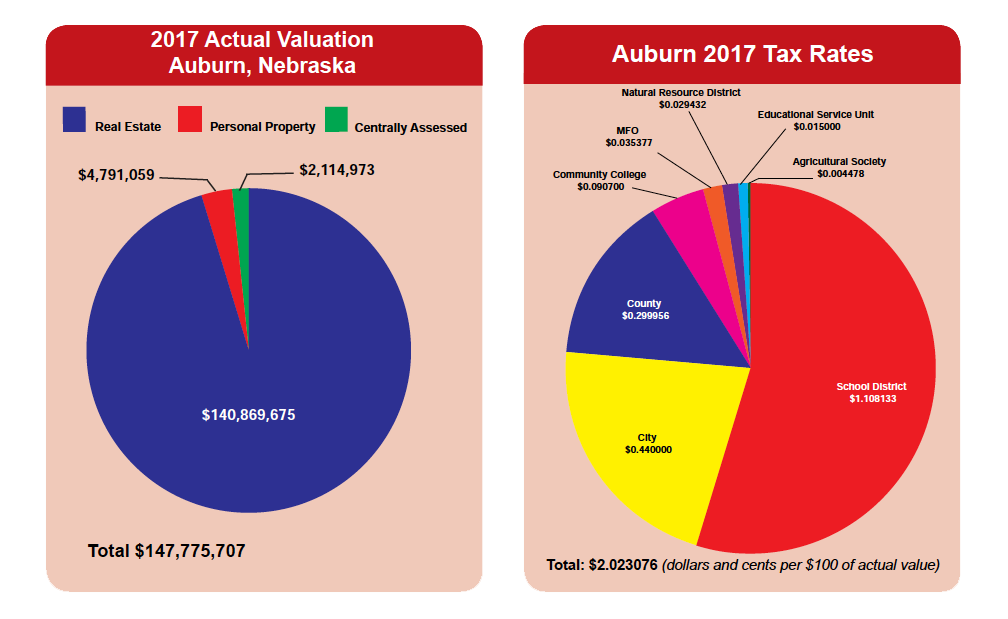

Property taxes are levied against real and personal property by local political subdivisions such as counties, cities, school districts, fire districts, etc., to provide for local services. All real property except agricultural land is assessed at actual or market value. Agricultural land is assessed at 75 percent of actual value. Personal property is assessed at net book value. Tax rates are expressed in dollars and cents for each $100 of actual value.Market value is determined by each county assessor through professionally accepted mass appraisal methods, which include, but are not limited to:

- Comparison with sales of real property of known or recognized value, taking into account location, zoning, current functional use, and other statutory guidelines (sales comparison approach)

- Earning capacity of the real property (income approach)

- Cost less depreciation (cost approach)

Nebraska Tax Incentives

Nebraska’s performance-based tax incentive programs demonstrate the state’s commitment to creating a favorable business environment for your business expansion or location. Known collectively as the “Nebraska Advantage Package,” this multi-tiered program provides investment credits, wage credits, sales tax refunds based on investment and job creation in Nebraska. Qualified companies, large and small can take advantage of these benefits. For more information on the qualifications and potential benefits available to your company, contact the Nebraska Department of Economic Development (800) 426-6505 or visit www.neded.org.